Who Can Register for the OSS?

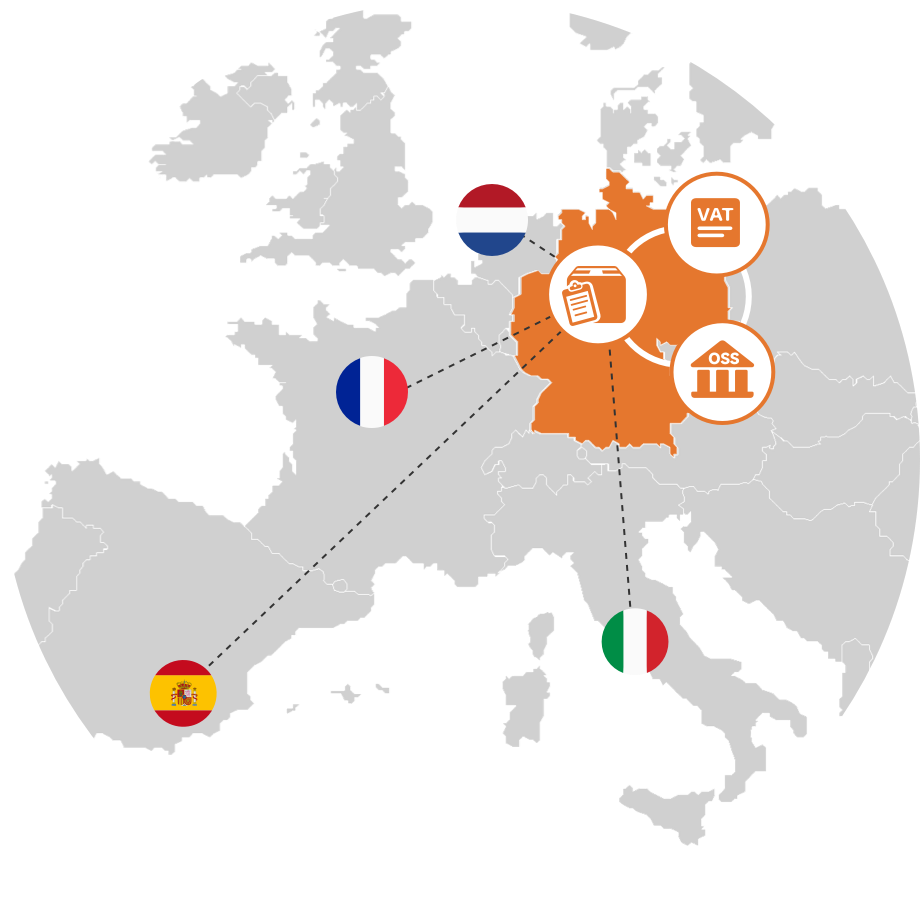

01 Union OSS

02 Non-Union OSS

03 IOSS

Union OSS

Any

taxable person

established in the EU who

supplies services to non-taxable persons taking place in a Member State where that taxable person has no establishment and/or

carries out intra-Community distance sales of goods

Any taxable person not established in the EU who

carries out intra-Community distance sales of goods

Any taxable person who is a deemed supplier who

carries out intra-Community distance sales of goods and/or

domestic supplies of goods